What We Do

Wolker & Associates Private Wealth Management is a unique private wealth management boutique specializing in total solution financial life planning. We assist high-net-worth families by providing value focused solutions tailored to specific client needs.

Our team will:

- define your personal financial philosophy to assist you in clarifying the financial planning solution.

- assist you in design and implementation of your personal financial life plan.

- simplify the decision process by putting you in the place of most potential to achieve desired financial planning objectives and goals.

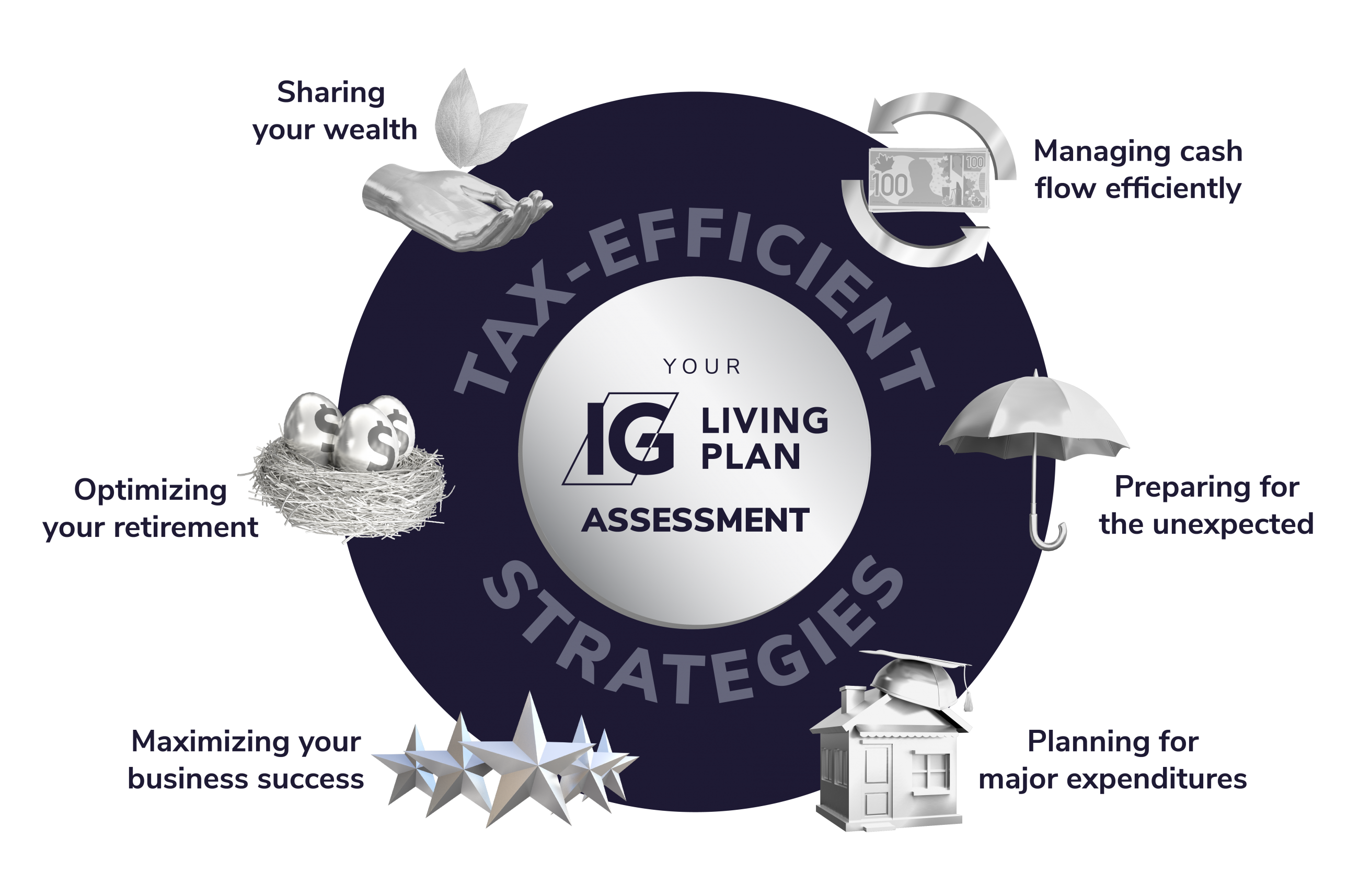

A holistic view of your wealth and your life

Our financial planning approach incorporates integrated tax and risk management strategies across six key dimensions of your financial life.

Managing cash flow efficiently

We examine and continuously evaluate your cash and credit needs to deliver the flexibility you require to meet your goals. From detailed cash flow analysis to tax-efficient income planning, we develop strategies tailored to you.

Optimizing your retirement

We’ll help manage the risks of retirement, preserving the capital you’ve built and create a tax-efficient income stream to support your needs and goals.

Preparing for the unexpected

We can’t always anticipate the challenges that we may be faced with, but we can plan for them. We’ll help you develop comprehensive risk management strategies to provide for those you care about.

Planning for major expenditures

We ensure you have the right plan in place to make your goals a reality – whether this includes education planning, investment or retirement property purchases, or other significant capital requirements.

Sharing your wealth

Establishing how to share your wealth will allow your legacy to live on for the people and causes you care about, including philanthropy, charitable giving, and intergenerational wealth and estate planning.

Maximizing your business success

From optimizing corporate investments to business succession planning, we implement strategies that synchronize and enhance your personal and business needs.

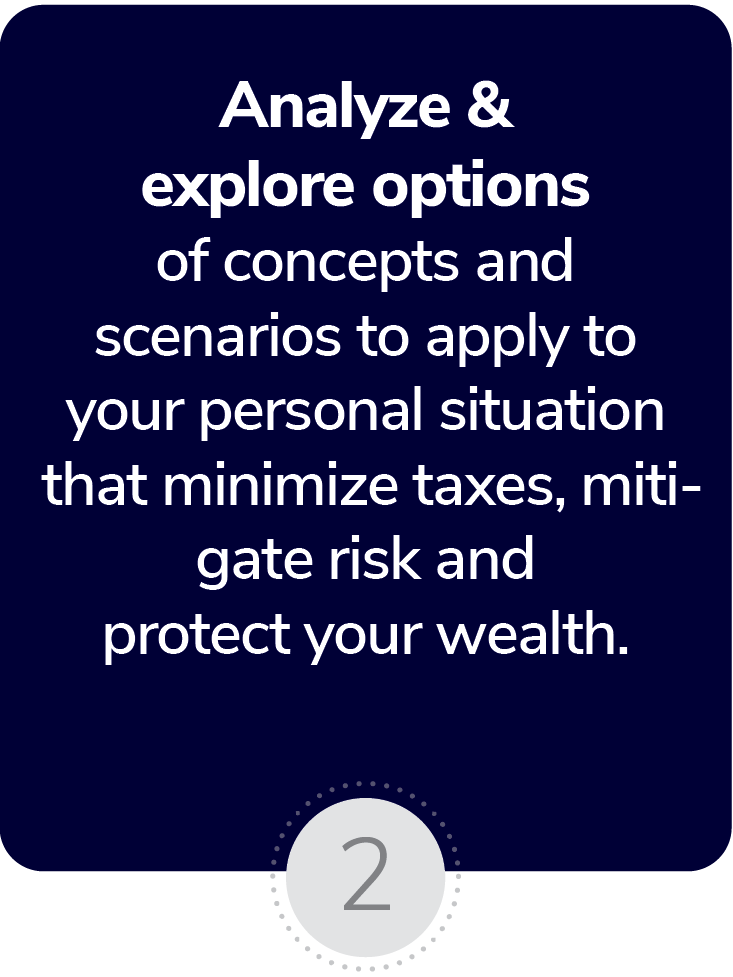

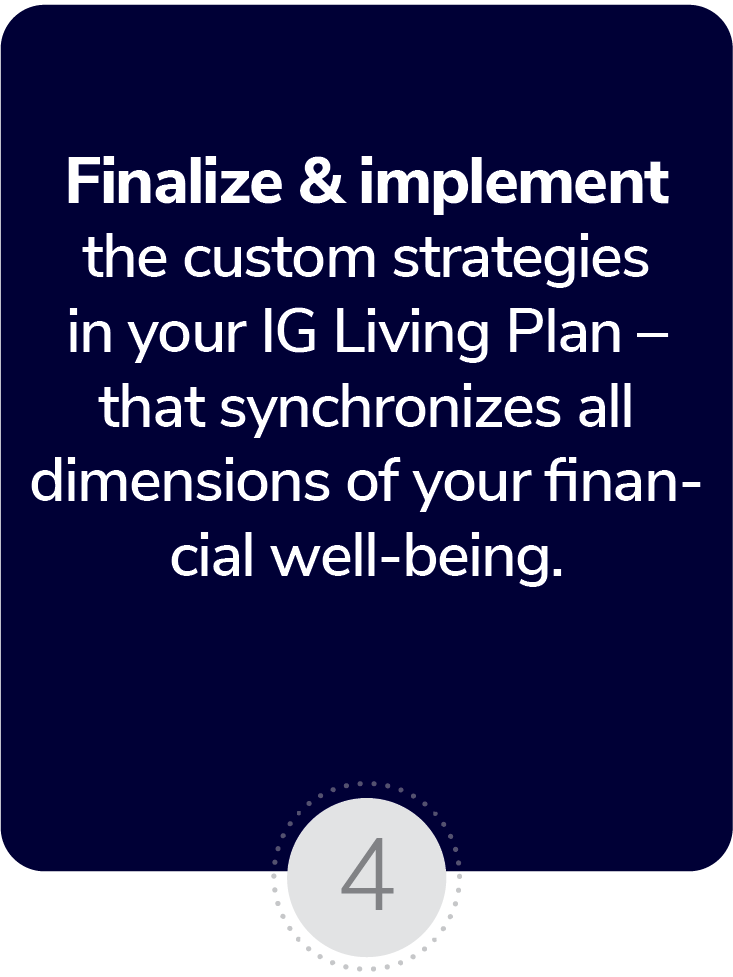

A process designed around you

There’s no such thing as a one-size-fits-all approach to financial planning, so we begin by understanding what really matters to you.

We’ll clarify your goals and concerns, evaluate your current financial situation, and synchronize six major areas of your financial well-being to create your IG Living PlanTM.

As your life moves through different phases, our ongoing process will proactively monitor and respond to you–reflecting our comprehensive, yet flexible team-based approach to financial planning that can deliver a deeper emphasis on any aspect of your living plan.

Is your financial well-being on track?

Try our IG Living Plan Snapshot to find out. This straightforward online tool will help you assess if you’re on track to meet your goals, based on key dimensions of your financial well-being. From optimizing your retirement to preparing for the unexpected, answer a series of questions to provide an overall result out of 100. This tool also provides personalized recommendations to help create a comprehensive financial plan tailored to you and your family’s needs.